Get the edge over other buyers, and a $10,000 seller guarantee

I Want the Edge!

1749 Mallory Lane, Suite 100, Brentwood, TN 37027

Do we sound like a broken record stating that the real estate market is challenging right now? As Realtors, you already know. You’re doing your best every day to help people become homeowners.

That’s why it’s imperative to make sure your clients know every home loan program available. One of these is Rate Relief by Churchill Mortgage.

Let’s talk about the basics of this option:

With Rate Relief, a buyer temporarily lowers their interest rate by having the seller or builder pay a certain amount upfront.

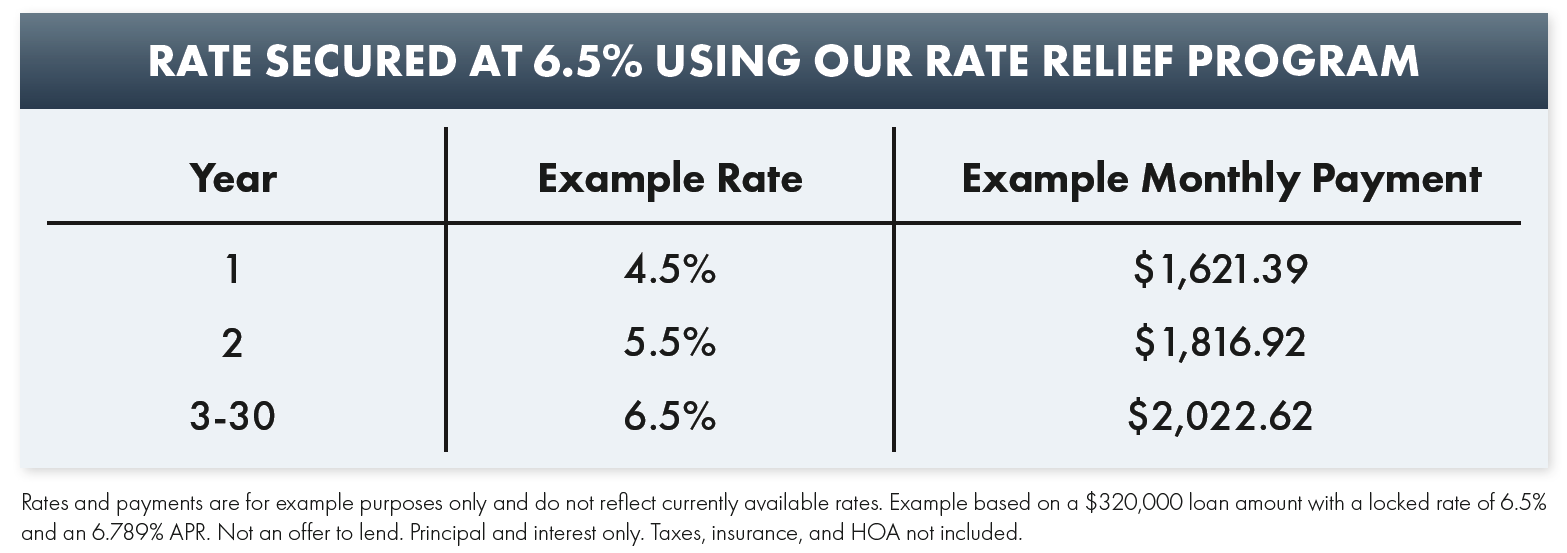

Here is an example of what this would look like:

As you can see, Rate Relief allows the buyer to ease into homeownership. They can adjust their budget the first two years to allow for financial success in the third year. One way to do this (if possible) is by putting the difference of the first year and the third-year monthly mortgage payment into savings. This will give the buyer some cushion when it comes time to pay the full amount.

The buyer can also potentially refinance at the third year, lowering their interest rate before they have to pay the standard rate from the original loan.

When explaining this home loan to a buyer, you want to mention that it has the advantage of an Adjustable Rate Mortgage (ARM) without the risk. As we see interest rates go up, more people are interested in the temporary relief that comes from an ARM without considering the reality.

Since interest rates fluctuate, an ARM loan may work in a buyer’s favor, but it may also work against them. It all depends on where rates are. With Rate Relief, the buyer receives the benefit of a lower rate without the risk of not knowing what rates will be in the future.

For sellers, Rate Relief can bring in more offers. Rates were incredibly low in 2020 and 2021, allowing buyers to have more buying power. As rates have increased, we’re seeing people priced out of the market, especially those buying for the first time. The reprieve that comes with Rate Relief offers the possibility of homeownership to more buyers. It will also allow sellers and builders to attract offers on a home that isn’t moving off the market.

For builders, this type of loan can be a great marketing tool. It provides an incentive for buyers to choose their new build over another home. If the builder offers Rate Relief without greatly increasing the price of the home, it’s not only helpful to the buyer, but encourages referrals.

Here are some talking points you’ll want to cover when discussing Rate Relief with your buyers:

To make the home buying process even easier for buyers, we offer other unique to Churchill advantages in addition to Rate Relief:

First, we encourage buyers to cap their interest rate (in this case, the third-year interest rate) for up to 90 days while looking for their new home. In addition, your client can become a Certified Home Buyer, which positions them like a cash buyer. By doing most of the underwriting work up front, this makes your buyer’s offer more attractive to a potential seller.

The Rate Relief program will look different for each buyer who uses it. To make sure your buyer is getting the smartest mortgage plan possible, we recommend partnering with a Churchill Home Loan Specialist. Your client will have peace of mind knowing that you and their mortgage company are working together to do what’s right for their long-and short-term goals.

If you have any questions about Rate Relief or any other loan programs as we navigate this real estate market, reach out! Our team is happy to help.

The Churchill Certified Home Buyer program is not a commitment to lend funds and is not an approval but is a conditional approval subject to your acceptance of the terms and the conditions being fully satisfied prior to closing. All conditions are subject to final underwriting and final investor approval. The certification is subject to the financial status and credit report(s) of everyone on the application remaining substantially the same until closing, an acceptable contract of sale on a suitable property, collateral (the appraisal, title, survey, condition, and insurance) satisfies the requirements of the lender and loan selected is still available in the market. All closing conditions of the lender must be satisfied including the clear transfer of the title, acceptable and adequate title and hazard insurance, flood certification, and any inspections that are required by the real estate contract.

Rate Secured is available on 30-year conventional conforming and high-balance fixed-rate loans. Rate Secured is not available on investment property home loans.

Seller Guarantee is for qualifying borrowers and select loan types only and are not available in all states or locations. Offer only valid on home loans closing on or before December 31st, 2022.

By submitting this form, I/we agree to your Privacy Policy Terms of Use and authorize Churchill Mortgage Corporation and/or their Preferred Provider for our area and/or The Churchill Agency to receive the above information to assist in obtaining a home loan.

I/we also authorize Churchill Mortgage Corporation, The Churchill Agency and/or their Preferred Provider for our area to contact us regarding but not limited to mortgage and insurance services and products via telephone, mobile phone (including through automated dialing), and/or email, even if telephone numbers or email I/we provide are on any Do Not Call/Contact Registry, such as corporate, state, or the National Do Not Call Registry.

The submission of this form does not constitute in any way a formal loan application or a commitment for a loan. By communicating with us by phone, you consent to calls being recorded and monitored. By participating, you consent to receive text messages sent by an automatic telephone dialing system. Consent to these terms is not a condition of purchase.

Agent Resources is created and managed by Churchill Mortgage, NMLS: 1591.

Churchill Mortgage Corporation, NMLS #1591 is an Equal Housing Lender - ©2020 All Rights Reserved. Programs are for select loan types only and are not available in all states or locations.

NMLS Consumer Access Privacy